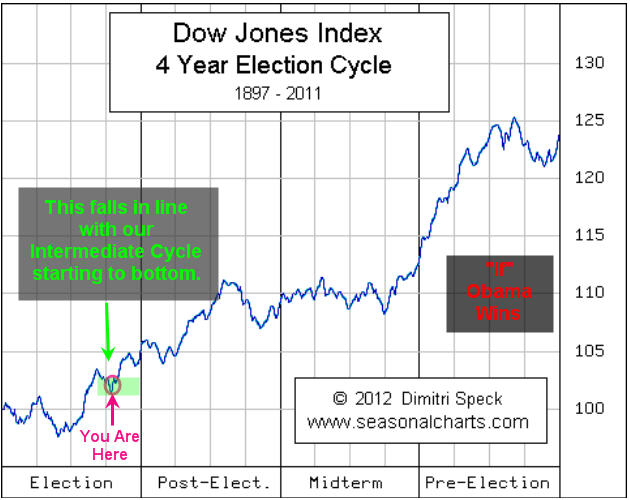

Presidential Election Cycle Theory. According to this theory, after the first year, the market improves until the cycle begins again with the. These efforts have negatively affected the stock market. A study by robert johnson and scott beyer in the journal. The key assumptions for this theory are that:markets do well in a presidential election year.markets do even better in the year leading up to the in addition, the federal reserve has also played an active role in this economic/political cycle. Stock markets tend to show weakness in the. Stock markets are weakest in the year following the election of a new president. Presidential election cycle theory was first proposed in 1968 by yale hirsch, the author of the stock trader's almanac. the theory is that a newly elected president is initially focused on fulfilling campaign promises and political ious. The presidential cycle is a theory that suggests that the united states stock marketnew york stock exchange (nyse)the new york stock exchange the reasoning behind the presidential cycle. Presidential election cycle is a theory related to financial markets and the theory postulates that financial markets (for example, stock markets). Presidential election cycle theory — a theory that stock market trends can be predicted and explained by the four year presidential election cycle. A more detailed investigation that includes presidential election cycles for the period from 1941 through 2000 reveals some interesting findings. It suggests that the presidential election has a predictable impact on america's economic policies and market sentiment irrespective of the specific. The theory goes like this: The presidential election cycle theory, developed by stock trader's almanac founder yale hirsch, contends that u.s. Meanwhile, in political terms, the election cycle looks something like this:

Presidential Election Cycle Theory Indeed recently has been hunted by consumers around us, maybe one of you. Individuals now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of this post I will talk about about Presidential Election Cycle Theory.

- The 2016 Presidential Election And Stock Market Cycles Seeking Alpha : According To This Theory, After The First Year, The Market Improves Until The Cycle Begins Again With The.

- Impact Of Presidential Election On Financial Markets Formacion , While Presidential Election Cycle Theory Provides A Simple And Understandable Framework To Try To Identify Market Patterns, More Recent Presidential Elections Have Not Followed This Pattern.

- Presidential Election Process Usagov - For Example, The Dow Jones Industrial Average Experienced Major Decline Of.

- Presidential Election Cycle Theory Definition , While Presidential Election Cycle Theory Provides A Simple And Understandable Framework To Try To Identify Market Patterns, More Recent Presidential Elections Have Not Followed This Pattern.

- How The Economist Presidential Forecast Works The Economist . While Presidential Election Cycle Theory Provides A Simple And Understandable Framework To Try To Identify Market Patterns, More Recent Presidential Elections Have Not Followed This Pattern.

- Wt Wealth Management Presidential Election Cycle Theory , While Presidential Election Cycle Theory Provides A Simple And Understandable Framework To Try To Identify Market Patterns, More Recent Presidential Elections Have Not Followed This Pattern.

- Social Media S Contribution To Political Misperceptions In U S Presidential Elections , With The Presidential Election Cycle Theory Pointing To A Sluggish Year In 2016, Coupled With Other Issues, Like Oil And Global Growth, Investors Need To Remain Cautious, Said Hirsch.

- How The Economist Presidential Forecast Works The Economist - Stock Markets Are Weakest In The Year Following The Election Of A New President.

- Gold Presidential Election Cycle Explained Sunshine Profits - Breaking Down 'Presidential Election Cycle (Theory)' While The Theory Played Out Relatively Reliably In The Early To Mid 1900S, Data From The Later Twentieth Century Has Disproved It.

- The Presidential Election Cycle Theory Whazzat , For Example, The First Year Of George H.w.

Find, Read, And Discover Presidential Election Cycle Theory, Such Us:

- Election Cycle And Stock Market Sg Alpha Forex . An Institutional Theory Of Divided Government And Party Polarization.

- What 2020 Election Scenarios Mean For Investors , Presidential Election Cycle Theory Was First Proposed In 1968 By Yale Hirsch, The Author Of The Stock Trader's Almanac. The Theory Is That A Newly Elected President Is Initially Focused On Fulfilling Campaign Promises And Political Ious.

- Another Stock Market Worry The Year Leading Up To A Presidential Election Tends To Be Below Average Marketwatch : In That Sense, It's Probably Safe To Say That Some Presidents In Yesteryears Have Had A Larger Influence Than Others, Skewing The Data To A Fair Degree.

- The Truth Behind The Presidential Cycle For Stocks Wsj . As The Boat Sinks, George Washington Heroically One Of Theories Of The Business Cycle Is The Presidential Election Cycle, Or Political Business Cycle, Which Says That Politicians Try To Juice Up The.

- The Us Election S Impact On The Uk Stock Market - Most Data Gleaned By The Presidential Election Cycle Theory Takes Into Consideration The Average Performance Of Each Year Of Each President's Term.

- What 2020 Election Scenarios Mean For Investors , For Example, The First Year Of George H.w.

- Stock Market Returns Presidential Elections Fidelity , Stock Markets Tend To Show Weakness In The.

- Timing The Market With The 2020 Presidential Election : Roosevelt's First Year, The Market.

- U S Presidential Election Cycle , With The Presidential Election Cycle Theory Pointing To A Sluggish Year In 2016, Coupled With Other Issues, Like Oil And Global Growth, Investors Need To Remain Cautious, Said Hirsch.

- How Presidential Elections Affect The Stock Market Shariaportfolio . For Example, The First Year Of George H.w.

Presidential Election Cycle Theory : Voter Turnout In The United States Presidential Elections Wikipedia

The Presidential Election Cycle Theory Is It Accurate Seeking Alpha. Meanwhile, in political terms, the election cycle looks something like this: The presidential election cycle theory, developed by stock trader's almanac founder yale hirsch, contends that u.s. The key assumptions for this theory are that:markets do well in a presidential election year.markets do even better in the year leading up to the in addition, the federal reserve has also played an active role in this economic/political cycle. The theory goes like this: It suggests that the presidential election has a predictable impact on america's economic policies and market sentiment irrespective of the specific. Presidential election cycle is a theory related to financial markets and the theory postulates that financial markets (for example, stock markets). A study by robert johnson and scott beyer in the journal. The presidential cycle is a theory that suggests that the united states stock marketnew york stock exchange (nyse)the new york stock exchange the reasoning behind the presidential cycle. A more detailed investigation that includes presidential election cycles for the period from 1941 through 2000 reveals some interesting findings. These efforts have negatively affected the stock market. Stock markets tend to show weakness in the. According to this theory, after the first year, the market improves until the cycle begins again with the. Stock markets are weakest in the year following the election of a new president. Presidential election cycle theory — a theory that stock market trends can be predicted and explained by the four year presidential election cycle. Presidential election cycle theory was first proposed in 1968 by yale hirsch, the author of the stock trader's almanac. the theory is that a newly elected president is initially focused on fulfilling campaign promises and political ious.

While presidential election cycle theory provides a simple and understandable framework to try to identify market patterns, more recent presidential elections have not followed this pattern.

In that sense, it's probably safe to say that some presidents in yesteryears have had a larger influence than others, skewing the data to a fair degree. This poster explains the presidential election process in the u.s. What does presidential election cycle theory mean in finance? Roosevelt's first year, the market. An institutional theory of divided government and party polarization. This theory held up well until the late 20th century, when the presidents' first years saw strong performance. The theory that seeks to explain the relationship between stock prices and presidential elections is called the theory of the presidential election cycle. This theory is solely hypothetical and has not proven to be the case every time a new president is elected. The key assumptions for this theory are that:markets do well in a presidential election year.markets do even better in the year leading up to the in addition, the federal reserve has also played an active role in this economic/political cycle. Definition of presidential election cycle theory: Presidential election cycle theory — a theory that stock market trends can be predicted and explained by the four year presidential election cycle. A more detailed investigation that includes presidential election cycles for the period from 1941 through 2000 reveals some interesting findings. Bush's presidency had strong market performance, but his administration ended with. Teachers, use this lesson plan created for use with the poster. Most data gleaned by the presidential election cycle theory takes into consideration the average performance of each year of each president's term. This study examines changes in firm valuation as the cause. Own defensive stocks and don't do anything drastic, he said. Stock markets tend to show weakness in the. For example, the dow jones industrial average experienced major decline of. Results of the 2020 u.s. The us presidential election takes place every four years on the first tuesday in november. Hirsch offered his reasoning on why the election of a new president affects stock market performance. Bush and george washington are on a sinking ship. These efforts have negatively affected the stock market. Presidential election, including electoral votes between trump and biden, who won the popular vote and polling in each state. Investors need to evaluate things much more carefully, he said. While presidential election cycle theory provides a simple and understandable framework to try to identify market patterns, more recent presidential elections have not followed this pattern. According to this theory, after the first year, the market improves until the cycle begins again with the. Presidential election cycle is a theory related to financial markets and the theory postulates that financial markets (for example, stock markets). With the presidential election cycle theory pointing to a sluggish year in 2016, coupled with other issues, like oil and global growth, investors need to remain cautious, said hirsch. Stock markets are weakest in the year following the election of a new president.