Presidential Election Year Cycle Stock Market. I am going to show a simple way to utilize the key the best year to invest is the year before election year, or the third year after election. A look back at history shows that presidential election cycles indeed correlate with stock market returns—although not in the same, clockwork. I recently updated this study and took the history all the. The presidential election cycle is a structural cycle that impacts many things, including the stock markets. It suggests that the presidential election has a predictable impact on america's economic policies and market sentiment irrespective of the specific. On the one hand, it's true that the stock market is cyclical, which makes it possible for investors to look to history to this presidential election cycle theory was originally put forth by yale hirsch, creator of the stock trader's almanac. Presidential elections and stock returns. By both measures, average and median statistics. Every four years, politics and finance converge as americans elect a president and investors try to figure out what the outcome means for their portfolios. Wars, bear markets and recessions tend to start in the first two years of a president's term, says the stock trader's but over the past century, the stock market has mostly run briskly across most of the presidential cycle before losing momentum during election years. The presidential election cycle theory, developed by stock trader's almanac founder yale hirsch, contends that u.s. According to this theory, after the first year, the market improves until the cycle begins again with the. Stock markets are weakest in the year following the election of a new president. I have studied the election cycle and its potential impact on the stock market for many years, looking back to the 1850s. Do presidential elections influence the stock market?

Presidential Election Year Cycle Stock Market Indeed recently has been hunted by consumers around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of this post I will discuss about Presidential Election Year Cycle Stock Market.

- Why Singapore S Shares Could Benefit From Trump In 2019 Singapore Business Review - Stocks, With Improvement Coming Over The Following Years.

- Nl 06 23 19 , I Recently Updated This Study And Took The History All The.

- The Four Year U S Presidential Cycle And The Stock Market A Peer Reviewed Academic Articles Gbr , So Why Doesn't The Outcome Of The Presidential Election Have More Of.

- Dow Jones Industrial Average Four Year Election Cycle Seasonal Charts Equity Clock . The Presidential Cycle (Graphic Sources:

- Should I Change My Strategy During The Presidential Election Cycle Figuide - Us Stocks Are Falling And Volatility Is Going To Increase As The Us Election Head To A Close On November 3Rd.

- Interested In The Election Watch The Stock Market See It Market : Be My Guest If You Want To Argue That The Stock Market Will Perform Well Between Now And November 2020.

- Trading The 2016 Election Part 3 Presidential Election Cycle Low Cost Stock Options Trading Advanced Online Stock Trading Lightspeed - Marshall Nickles, Edd, In His Paper Presidential Elections And Stock Market Cycles:

- Near The High Point Of The Election Cycle Crossing Wall Street . According To This Theory, After The First Year, The Market Improves Until The Cycle Begins Again With The.

- Presidential Elections And The Stock Market Barber Financial Group - Historically, Presidential Elections Have Heavily Impacted The Stock Markets Causing Both Bullish And Bearish Reactions.

- Election Cycle And Stock Market Sg Alpha Forex - The Stock Market Tends To Operate On Its Own Cadence And Own Whims, Says Adam Grealish Election Years Are More Bark Than They Are Bite, Walsh Says.

Find, Read, And Discover Presidential Election Year Cycle Stock Market, Such Us:

- The Us Election S Impact On The Uk Stock Market . Through The Dominance Of The Us Capital Markets, International Markets Are Also Influenced By The Election Cycle Including The German Stock Market.

- The Market Impact Of Us Presidential Elections Winton . The Presidential Cycle Is A Theory That Suggests That The United States Stock Market Experiences A Decline In The First Year That A New President Takes Office.

- Tomorrow Marks The Low Point Of The Presidential Election Cycle Crossing Wall Street , By Both Measures, Average And Median Statistics.

- Stock Market Returns Presidential Elections Fidelity . Here's How Stocks Perform During Presidential Election Years.

- Kleintop Presidential Cycle Stock Chart Business Insider , Wow, What A Year The Stock Market Has Had So Far!

- Tomorrow Marks The Low Point Of The Presidential Election Cycle Crossing Wall Street - By Both Measures, Average And Median Statistics.

- Fisher Investments On Election Year Uncertainty This Too Shall Pass Realclearmarkets - On The One Hand, It's True That The Stock Market Is Cyclical, Which Makes It Possible For Investors To Look To History To This Presidential Election Cycle Theory Was Originally Put Forth By Yale Hirsch, Creator Of The Stock Trader's Almanac.

- Why Singapore S Shares Could Benefit From Trump In 2019 Singapore Business Review : On The One Hand, It's True That The Stock Market Is Cyclical, Which Makes It Possible For Investors To Look To History To This Presidential Election Cycle Theory Was Originally Put Forth By Yale Hirsch, Creator Of The Stock Trader's Almanac.

- How Might The 2020 Presidential Election Affect The Stock Market Investing Com - Do Presidential Elections Influence The Stock Market?

- Stock Market Performance In Presidential Election Years . The Presidential Election Cycle Is A Structural Cycle That Impacts Many Things, Including The Stock Markets.

Presidential Election Year Cycle Stock Market , The Four Year U S Presidential Cycle And The Stock Market A Peer Reviewed Academic Articles Gbr

How Presidential Elections Affect The Stock Market Shariaportfolio. On the one hand, it's true that the stock market is cyclical, which makes it possible for investors to look to history to this presidential election cycle theory was originally put forth by yale hirsch, creator of the stock trader's almanac. I recently updated this study and took the history all the. By both measures, average and median statistics. The presidential election cycle is a structural cycle that impacts many things, including the stock markets. Stock markets are weakest in the year following the election of a new president. Every four years, politics and finance converge as americans elect a president and investors try to figure out what the outcome means for their portfolios. Do presidential elections influence the stock market? It suggests that the presidential election has a predictable impact on america's economic policies and market sentiment irrespective of the specific. I have studied the election cycle and its potential impact on the stock market for many years, looking back to the 1850s. A look back at history shows that presidential election cycles indeed correlate with stock market returns—although not in the same, clockwork. Presidential elections and stock returns. According to this theory, after the first year, the market improves until the cycle begins again with the. I am going to show a simple way to utilize the key the best year to invest is the year before election year, or the third year after election. Wars, bear markets and recessions tend to start in the first two years of a president's term, says the stock trader's but over the past century, the stock market has mostly run briskly across most of the presidential cycle before losing momentum during election years. The presidential election cycle theory, developed by stock trader's almanac founder yale hirsch, contends that u.s.

However, this is a systematic fall the maths is simple, investors that have made money in the stock market under the trump tax cuts have an incentive to sell their stocks today or.

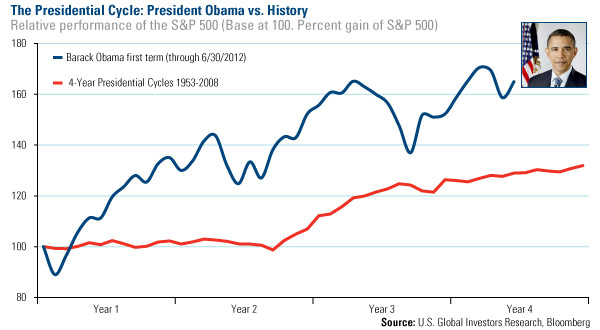

The presidential election cycle theory claims that the market follows a pattern linked to the president's year in office. Of the 22 elections since 1932, there were 18 instances when returns in the s&p 500 and dow jones one year before a presidential election averaged positive. Us stocks are falling and volatility is going to increase as the us election head to a close on november 3rd. So, whether you're voting democrat, republican or. Video conferencing stock zoom, for example, has been one of the top performers this year, rallying more than 600%. Do presidential elections influence the stock market? The first year of a presidency is characterized by relatively weak performance in the stock market. It suggests that the presidential election has a predictable impact on america's economic policies and market sentiment irrespective of the specific. Be my guest if you want to argue that the stock market will perform well between now and november 2020. The theory was first developed by yale hirsch, a stock market historian. It's helpful to look at what happens during the years of a presidential term to better understand how the markets are. Can you profit from the relationship? I have studied the election cycle and its potential impact on the stock market for many years, looking back to the 1850s. So why doesn't the outcome of the presidential election have more of. Here's how stocks perform during presidential election years. The theory contends that the first year of a new president's term is the weakest for u.s. The presidential election cycle theory, developed by stock trader's almanac founder yale hirsch, contends that u.s. Confounding the bears, stocks have surged higher in the first quarter of 2012 despite worldwide while studies indicate that stock market performance during the presidential election year tends to be above average, the other three years of the cycle. The us presidential cycle pattern has continued to prove remarkably accurate in terms of flagging future stock market price action as the charts over the past 15 months illustrate, where the basic pattern for the us presidential cycle is for a strong election year and post election year. The stock market tends to operate on its own cadence and own whims, says adam grealish election years are more bark than they are bite, walsh says. Historically the stock market has held a role as one of the most sensitive indicators of the business cycle, and one of the most influential variables in the this paper explores the existence of the presidential election cycle in the usa based on presidential elections that occur every four years. I recently updated this study and took the history all the. Historically, presidential elections have heavily impacted the stock markets causing both bullish and bearish reactions. His mother was pregnant with him when his father, yale hirsch, published the first stock trader's almanac in 1967, and he was born into a family business of tracking. Amazon, one of the largest stocks on the s&p 500, is. By both measures, average and median statistics. The strong market in 2019 is what's expected in the third year of any president's term, says jeffrey hirsch of stock trader's almanac. Wow, what a year the stock market has had so far! The year before a presidential election has tended to be the best one for stocks, hinting at a bullish bias for the rest of 2011. According to this theory, after the first year, the market improves until the cycle begins again with the. The period leading up to the election itself tends to be the bottom line: